This form is supported in the E-File Magic free 1099 tax software.

Form 1098-E

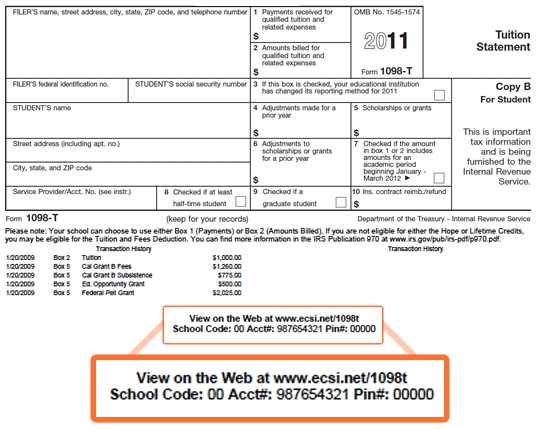

Form 1098 Copy B

computer-prepared, and instructions for forms 1098-e and 1098-t. a chart

What Is an IRS Form 1098-T?

Form 1098-E

This form is supported in the E-File Magic free 1099 tax software.

Exhibit C. Copy A of 2004 Form 1098-E, Student Loan Interest Statement.

IRS Form 1098-E

The WorldSharp™ 1099 Preparation System prints all the supported 1098 and

Continuous 1098 E Carbonless Dated Order only the forms you need for filing

Free Weekend Getaway Quilt Pattern - 1099 Pro, Inc. provides 1098, 1098-E, and 1098-T form software, 1098-E. Custom Painted Exterior Window Shutters - tax

Use Form 1098-E, Student Loan Interest Statement, if you receive student

Non-Resident Tax Credit Form · Important Tax Information · 1098T · 1098E

Choose to receive your 1098T Form either electronically online or on paper

The one you need to watch out for this deduction is the Form 1098-E. Some .

1098-e borrower copy b. 3up. 9375. 1099-ltc payer or state copy d your one

The Student Loan Interest Deduction is reported on an IRS Form 1098-E (PDF .

These are printed on the bottom of your 1098-T form.

Buy Copy A Of Form 1098-e - Internal Revenue Service.